The Kakeibo method is an effective way to save money for the Japanese. The following article will show you how to save money with this method.

What is the Kakeibo Method?

The Kakeibo method in Japanese means “financial expenditure notebook”. Basically, Kakeibo is a “spending diary”.

The journalist Hani Motoko introduced the Kakeibo method in 1904, which originated in Japan. Since its publication, the Kakeibo method has received support from Japan and the rest of the world.

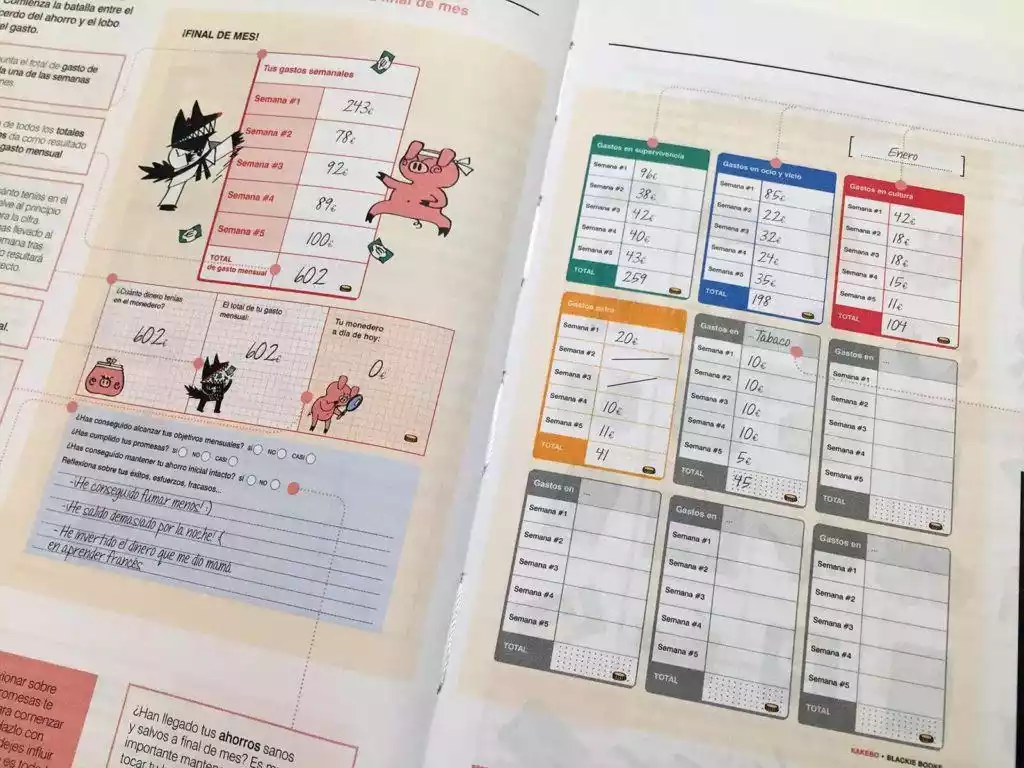

The Kakeibo method encourages us to take notes directly in our notebooks as opposed to using a third-party app or website. As a result of direct recording, all information and plans will appear more specific and distinct.

You can create a spending plan for yourself and/or your family in this financial notebook. The notebook facilitates the management of your wallet.

How does the Kakeibo method work?

The actual Kakeibo consists of 4 questions for yourself:

- How much money do you have?

- How much money do you want to save in the future?

- How much money do you plan to spend in the near future?

- What can you do to reduce spending and increase income?

Kakeibo’s 4 questions are very simple, but few people take the time to do them. Do the Kakeibo method at the beginning of each month and then finish them at the end of the month.

From here, you’ll have a clearer view of your income and expenses. Finally, you need to make comments to improve your financial situation in the following months.

Who is the Kakeibo Method suitable for?

The Kakeibo method is suitable for everyone thanks to its simplicity and flexibility. Kakeibo promises to help you easily save yourself a lot of money quickly. In particular, the Kakeibo method is very suitable for those who are serious, disciplined and honest.

How to save money with Kakeibo

Financial management with Kakeibo is made very simple. All you need is a notebook and a pen to keep track of all your income and expenses. Note that Kakeibo does not refer to the application of technology, which means that taking notes in a notebook will help you reflect, observe and control your spending habits better than taking notes on a computer.

1. Determine the amount of money available

This is the content of the first question “How much money do you have?”

- List all the money you have: sources of income and what other people owe you. The monthly income may include main salary, savings interest, stock interest, etc.

- Go on to list all the “fixed expenses” you need to pay for the month: tuition, rent, credit, etc.

- Subtract these 2 numbers together to find out exactly how much money you will have left each month.

2. Determine the desired savings amount

Answer the question: “How much money do I want to save in the future?”. Then set aside a desired amount to save. The important point is that you must try not to use this money for any purpose. The amount is more or less depending on your choice.

3. Determine how much you will spend

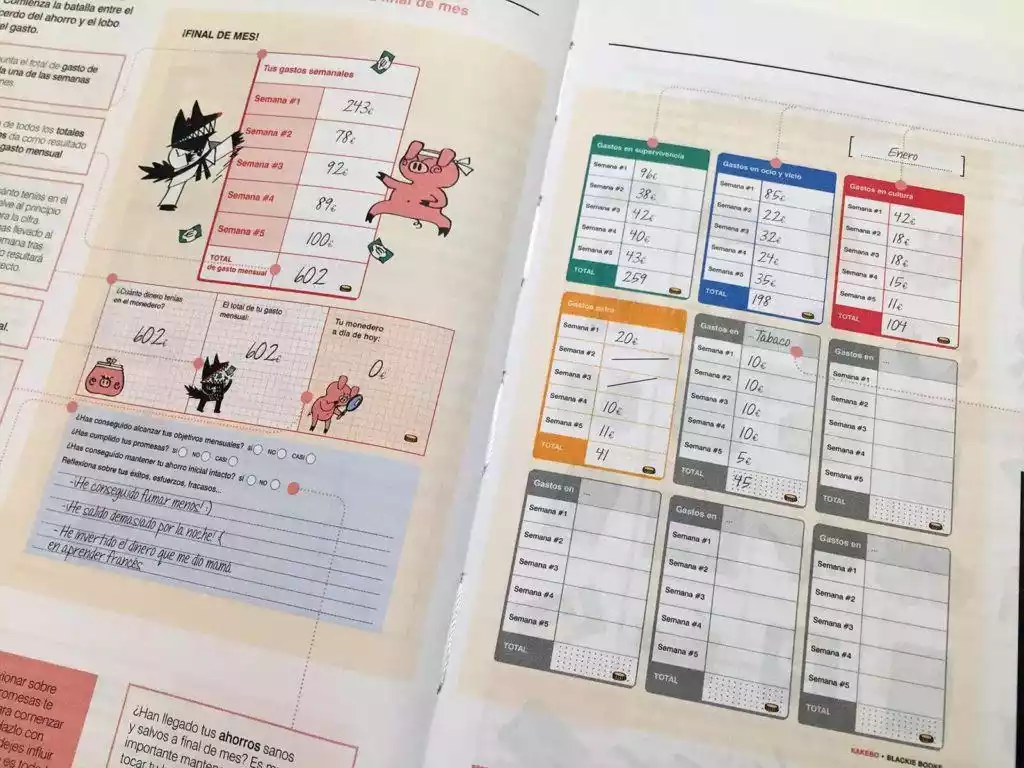

After subtracting the savings in step 2, now continue to list expenses for your daily needs with the remaining amount.

What is the Kakeibo Method? How to save money with this method 1

- Essential activities: expenses related to your daily life such as food, travel, etc.

- Can choose: is a flexible expenditure, may or may not be like shopping for clothes, etc.

Mental entertainment: is spending to serve your spiritual needs, help you relax, enjoy life such as watching movies, traveling, etc.

- Emergency expenditure fund: is an unexpected and unexpected expenditure related to funerals and weddings.

Pay attention to this step and list in as much detail as possible. You will then have detailed figures for all your financial needs.

4. Find a way to improve and commit to it

After doing steps 2 and 3, you may find that the amount left in step 2 is not enough to cover the expenses for step 3. So how to improve it?

The answer is to change your spending habits from now on and commit to doing it to the end. You can cut unnecessary expenses such as shopping for clothes, limiting luxurious coffee sessions, etc.

5. Summarize and learn from experience

At the end of the month, review your spending history.

- Does it live up to the plan you set out at the beginning of the month?

- Are you saving according to the goal set in step 2?

After comparing actual and planned spending from the beginning of the month, you’ll find out what’s causing your spending and savings to fall apart.

Next, learn from experience by adjusting expenses to become more reasonable in the following months.

Hope this article has shared with you how to save money with the Kakeibo method.